About Authors:

About Authors:

Ritul bapna

LMC of science and technology,

Jodhpur

*bapnaritul89@gmail.com

1. Introduction

The principal law for patenting system in India is the Patents Act, 1970. Initially, according to the provisions of this law no product patent but only process patents could be granted for inventions relating to food, drugs and chemicals. However, since 2005 product patenting is allowed in India. India being a member country of World Trade Organization (WTO) signed TRIPS (Trade Related Aspects of Intellectual Property Rights) Agreement in laws to be followed by each of its member countries. India being a signatory of the TRIPS agreement was under a contractual obligation to amend its Patents law to make it compliant with the provisions of the agreement. The first amendment in this series was in the form of the Patents (Amendment) Act, 1999 to give a pipeline protection till the country starts giving product patents. It laid down the provisions for filing of applications for product patents in the field of drugs and agrochemicals with effect from 1st January1995 as mailbox applications and introduced the grant of Exclusive Marketing Rights (EMRs) on those patents. To comply with the second set of TRIPS obligations India further amended the Patents Act, 1970 by the Patents (Amendment) Act, 2002.Through this amendment provision of 20 years uniform term of patent for all categories of invention was introduced. The third set of amendments in the patent law was introduced as the Patents (Amendment) Act, 2005. Through this amendment product patent regime was introduced in India. To implement its TRIPS obligations, India passed changes to its patent law in 2005 so that medicines could now be patented. However, the new law also contained the flexibilities. India has one of the best patent laws in the world in terms of giving some space to its producers to make generic medicines.

Reference Id: PHARMATUTOR-ART-1549

2. Impact of product patentability

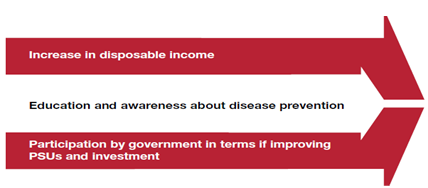

The new law, amending India's 1970 Patent Act, affects everything from electronics to software to medicines, and has been expected for years as a condition for India to join the World Trade Organization. Even after 16 years of TRIPS transition, the debate continues as to whether TRIPS and the IP patent Scenario post-TRIPS triggered further growth of the Indian pharmaceutical industry or not. Abundant doomsday predictions, ever since the commencement of the Uruguay Round, disappointingly for some, did not come true. In the overall analysis, the Indian pharmaceutical industry woke up, took note of the new rules of the game, prepared them and commenced to master the IP/patent based international trade regime. Post-TRIPS, there has been major thrust in the Indian pharmaceutical industry, some of which are as follows:

(a) Increased patent awareness and proficiency creation

(b) Patent-expiry based thrust of generic pharmaceutical companies into the markets of developed countries such as USA and EU.

(c) Increase in domestic as well as overseas patenting activities by Indian pharmaceutical companies

(d) Steep increase in USFDA, EDQM, EMA (EU) inspections and approvals to Indian pharmaceutical companies, lifting India to 2nd position after USA

(e) Large DMF and ANDA filings as well as increase in 505(b)(2) filings and Para IV patent challenges in USA, prior to patent expiries.

(f) Larger outlay in R & D expenditure by Indian pharmaceutical companies

(g) Increase in funding by agencies including Government departments such as DST, DBT and others for pharmaceuticals research

(h) A new and welcome initiative by Government of India in ‘New Drug Discovery Research’

The transition from ‘licence of right’ (automatic compulsory licence) to the new regime was expected to exhaust the options for the generic industry. With the support of the law-makers, the entrepreneurial pharmaceutical industry picked up the gauntlet and took full advantage of the new globalized and harmonized regime to enter new markets including advanced regulated markets and developing countries which had non-tariff regulatory barriers.

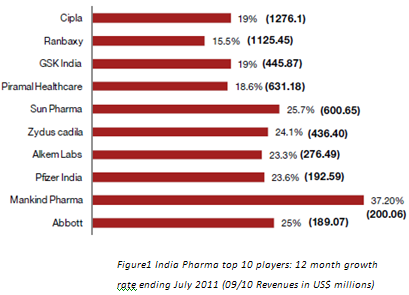

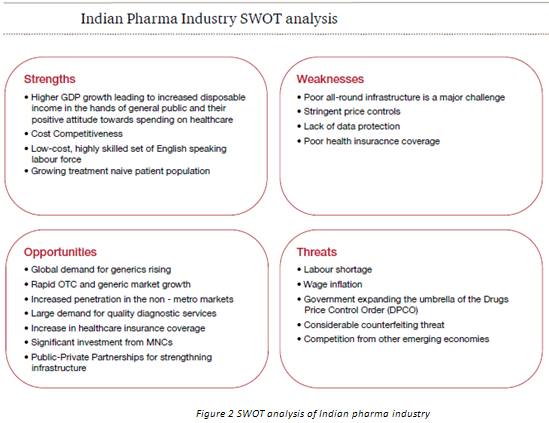

3. Current Scenario - Indian pharma Industry

India's growing respect and legal / regulatory framework for IPR, favourable economic policies and availability of huge talent pool for sustaining and growing operations is making India an attractive choice for global pharma companies for investment, tie-ups, mergers, acquisitions. Because of patent expirations of blockbuster drugs, Indian firms are expected to actively participate in the production of generic version of these products

(a) In 2011 itself, more than a third of the ANDA approvals were by Indian firms.

(b) Indian companies managed to get 88 ANDA approvals from US FDA during the first half ended June 2012 which worked out to 41.1 per cent of the total approvals of 214 ANDAs.

(c) Further, Indian pharma companies obtained 21 tentative approvals during January-June 2012 from US FDA as against 19 in the corresponding period of last year. The total tentative approvals were 49 during the first half of 2012 as compared to 50 in the last period

(d) Sun Pharma- 12 products during the first half of 2012. Aurobindo Pharma, Dr Reddy's Laboratories and Strides Arcolab - 9 final approvals each.

The total tentative approvals were 49 during the first half. US FDA issued 117 tentative approvals during year ended December 2011, out of which Indian companies captured 49 approvals.The higher number of approvals from highly regulated markets helps to spread market presence in the lucrative markets and it will help to en-cash upcoming opportunities with the expiration of patents.

4. Challanges for generic drug makers

Pharmaceutical companies have managed their business in much the same way for decades. Indian pharma companies so far concentrated on marketing generic versions of drugs and no money was spent on basic Research and Development (R&D). Thus, Indian pharma companies have no experience of developing a new molecule. Further Indian pharma companies are not considered financially strong as it takes almost USD 1 billion to develop and market a drug to USD 6 billion according to various estimates. Considering this fact, it may be difficult for an Indian company to come up with a new molecule. The possible challenges such as:

(a) Generic v/s authorized generic-

Indian companies are facing Generic competition from “Authorized Generics” in the developed markets. Authorized Generics are the generic version of patented molecule marketed by the patent holder itself once the patent on the molecules expire.

(b) Price control -

Price controls are broadly cited as the most critical challenge that companies face in the Indian market. India is one of the most price-controlled markets in the world, as under the DPCO, prices and margins are monitored carefully. The DPCO is being supervised by the NPPA. However, 90% of drugs are currently outside of any price controls in India, but the industry believes that there is enough competition for the prices to be modulated by the market itself.Thus lack of enough return on investment (ROI) due to DPCO is ascribed as one of the reasons Indian companies were unable to invest heavily in R&D.

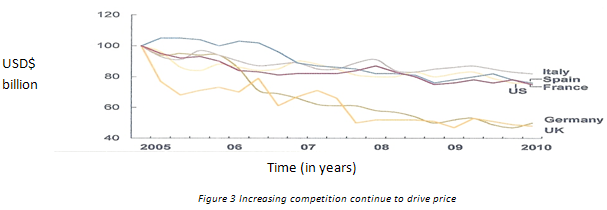

(c) Rising Competition-

About dollar 150 billion worth of drugs will set to off- patent in US, Japan and Europe exclusivity between 2010 and 2015. In the near-term, the generic opportunity will continue to lure more companies. And, with competition intensifying, generic drugs will see greater price erosion.

(d) Increasing development costs–

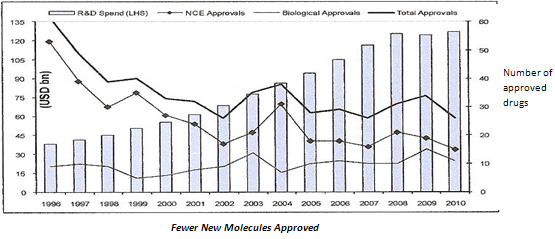

Along with higher competition, the global generic market is set to face another hurdle in the longer term. Already, R&D productivity of large global pharmaceutical players (innovators) has slowed considerably over the past few years. R&D productivity, a function of cost of new drug development and returns from those new drugs, is of critical importance as global players invest heavily in R&D (about 20 per cent of revenues). First, the average cost of developing a new drug has more than doubled in the past five years to USD 1.5 billion. Second, R&D activities by global players have resulted in only a handful of new molecules.

Figure 4: list of 2010 FDA New Drug Approvals

(e) Reducing drug approvals

Further, returns from these few novel drugs have not reached the scale seen in the previous decade. Unlike highly successful launches in the past, such as Lipitor, most patented drugs launched over the five years have not been able to garner sales in excess of USD1 billion. The slowing down of new drug launches will mean that the generic opportunity set to open up in the next decade (post 2020) is likely to be significantly lower.

5. Coping Strategies - the next level of growth:

Pharmaceutical companies have managed their business in much the same way for decades. But significant changes in government regulations, market conditions, and technology will force the industry to look for new business models and practices. Companies that don't adapt face an uncertain and unsettling future.

The suggested model is a three-tiered approach with

(a) First tier for research-based Indian pharmaceutical industry

(b) Second tier with the generic industry targeting maximum usageof TRIPS flexibilities as made available through the new patent

(c) Third tier is for approaching new emerging markets

(a) The first tier:the Indian research-basedcompanies

1. Shifting the R & D research model

It is disappointing that the pharma industry spent as much as Rs15000 crore on R&D during the past five years without producing a single new molecule. In sharp contrast, the US drug industry spends USD 55 billion on more than 450 drugs every year to come out with 26 new molecules. Nothing hopeful has come from Ranbaxy, Dr Reddy’s, Biocon and Sun Pharma—all companies with over 15 years of R&D experience. A major part of R&D expenditure has gone to reverse engineering, generics, contract research, clinical research and little to new molecule research. In the US, 80% of R&D expenditure goes to molecule research. That is why the US has high productivity in the entire chain of the molecule development cycle.

2. Develop India’s strength in vaccine production. Shift towards prevention

India is the one of the largest producers of measles, DPT (diphtheria, pertusis and tetanus) and BCG (bacille calmetteguérin) vaccines in the world. It produces about 40-70% of the WHO demand for DPT and BCG, and almost 90% of the demand for measles. Indian vaccines are produced and exported to 150 countries worldwide. Vaccine producer in India -

· The Serum Institute of India, todevelop vaccines against the lateststrain of H1N1.

· Panacea Biotec for supplying polio vaccines throughout the world.

· Global Alliance for Vaccines and Immunization (GAVI) to develop, manufacture and sell meningitis vaccines.

· Shantha Biotechnics was taken over by Sanofi Pasteur (the vaccine division of Sanofi-Aventis) and was awarded a contract by the United Nation (UN) to supply pentavalent vaccines worth USD 340 million over the period 2010-12.

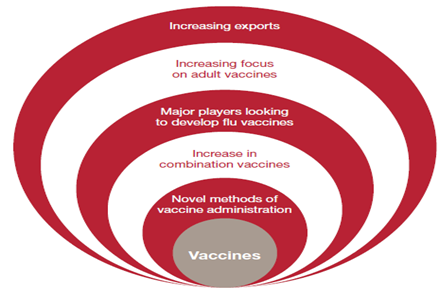

Figure 5: Factors driving the vaccine market forward

Globally, the vaccines sector is growing rapidly; there are now 245 pure vaccines and 11 combination vaccines in clinical development, and some industry experts estimate that the market could be worth as much as USD 42 billion. It will also boost demand for vaccines. This could ultimately generate new business opportunities for Indian Pharmacompanies.Shantha Biotechnics was taken over by Sanofi Pasteur (the vaccine division of Sanofi-Aventis) and was awarded a contract by the United Nation (UN) to supply pentavalent vaccines worth USD 340 million over the period 2010-12.

Figure 6 : Vaccine new industry trends

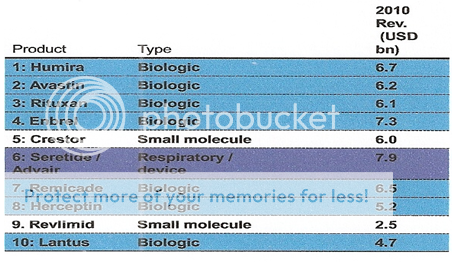

3. Develop India’s skills in bio-technology based drug production.

India's share of global biotech is just two to three per cent. The global biotech market is estimated at USD 300 billion and the size of the Indian biotech industry as of 2010 was about USD 3 billion. However, due to several advantages, it is expected to increase to 25 per cent by 2025. Biotech segment broadly comprises of bio-generics, bio-pharma, and contract research (CRAMS), bio-agriculture, bio-industrial and bio-informatics. Bio-pharma sector contributes about 60 per cent of total revenues. With the initiatives taken by the government, Indian Biotechnology is poised for a tremendous growth.

• Trained manpower and knowledge base

• Good network of research laboratories

• Rich Biodiversity

• Well developed base industries (e.g.: pharmaceuticals, seeds)

• Access to intellectual resources of NRIs in this area.

• Extensive clinical trials and research - access to vast & diverse disease populations

• Bio-diversity - human gene pools offer an exciting opportunity for genomic studies.

Figure 7: In 2016 out of Top 10, 8 will be Biologic product

4. Licensing Agreements

It is difficult to imagine Indian companies coming out with totally new molecule in near future due to prohibitive cost of developing a new molecule. But companies can enter licensing agreements with Multinational pharma companies for development of molecule. Indian companies can garner royalties out of these licensing agreements. Indian companies can either opt for Out-licensing of molecules for royalty payments or they can In-license some promising molecules. Thus, In-licensing and Out-licensing of potential and promising molecules is a lucrative option. Some Indian companies have already entered into these licensing agreements. Licensing agreements can be arrived at early stage of product development or at a later stage of development of molecule depending on the potential of molecule.

(b) The second tier: It would be to strengthen India’s generic industries. The following options might be considered:

1. Go for strategic deals on joint ventures with multinational companies (MNC).

Pharmaceutical MNCs are desperately trying to reduce the cost of research and are looking for developing country partners. “Manufacturing in low-cost countries such as India is a must, while growing markets can extend the profitable sales life of products for years after they have faded in US or Europe”. Indian generic manufacturers can undertake contract research and expand its generic hub.

2. Capitalise blockbuster patented drugs that are scheduled to go off patent

Global Generic Market at USD 231b in 2017Because of patent expirations of blockbuster drugs, Indian firms is expected to actively participate in the production of generic version of these products. Indian companies are also ready with generic version of biotech drugs. Therefore, India will be able to maintain a large basket of affordable generics.

|

Sr. No. |

Name of the drug |

Category |

Patent Holder |

Expiry Year |

|

1. |

Zafirlukast |

Respiratory |

Glaxo |

Sept. 2010 |

|

2. |

Zelienton |

Respiratory |

Abbott |

Dec., 2010 |

|

3. |

Atrovastatin Cal. |

C.V. |

Wartner |

Dec., 2010 |

|

4. |

Irbesartan |

C.V. |

Sanofi |

March, 2011 |

|

5. |

Olanzapine |

C.N.C. |

Eli Lilly |

April, 2011 |

|

6. |

Tirofiban |

C.V. |

Merck |

March, 2011 |

|

7. |

Rosuvastatin |

C.V. |

A.Z. |

June, 2012 |

|

8. |

Zolmitriptan |

Migraine |

A.Z. |

Nov., 2012 |

|

9. |

Frovatriptan |

C.N.C. |

GSK |

Nov., 2012 |

|

10. |

Valsortan |

C.V. |

Novartis |

March, 2012 |

|

11. |

Ertapenem |

Antibiotic |

Merck |

Feb, 2013 |

|

12. |

Caspofungi |

Antibiotic |

Merck |

March, 2013 |

|

13. |

Voriconazole |

Antibiotic |

Pfizer |

Oct, 2013 |

|

14. |

Rizatriptan |

Migraine |

Merck |

Jan., 2013 |

|

15. |

Eletriptan |

Migraine |

Merck |

Aug. 2013 |

|

16. |

Almotriptan |

Migraine |

Pharmacia |

Oct, 2013 |

|

17. |

Teriparatide |

Hormone |

Eli Lilly |

July, 2013 |

|

18. |

Risedronate Sodium |

Hormone |

P & G |

Dec, 2013 |

|

19. |

Imatinib Mesylate |

Oncology |

Novartis |

May, 2013 |

|

20. |

Insulin Lispro |

Diabetes |

Eli Lilly |

May, 2013 |

|

21. |

Insulin Aspart |

Diabetes |

Novo |

Sept, 1013 |

|

22. |

Rituximab |

Biopharm |

Gentech |

March, 2013 |

|

23. |

Decliximab |

Biopharm |

Protein Design |

June, 2013 |

|

24. |

Erytropoietin |

Biopharm |

Amgen |

Aug, 2013 |

|

25. |

Palvizumab |

Biopharm |

Medi Immune |

Dec., 2013 |

|

26. |

Tegaserod |

Gastro |

Novartis |

April, 2013 |

|

27. |

Montelukast |

Respiratory |

Merck |

Oct, 2013 |

|

28. |

Grepafloxacin |

Antibiotic |

Glaxo |

Dec, 2013 |

|

29. |

Colesevelam |

C.V. |

Geltek |

Dec, 2014 |

|

30. |

Linezolid |

Antibiotic |

Pharmacia |

Nov, 2014 |

|

31. |

Posaconazole |

Antibiotic |

Shering |

Aug, 2014 |

|

32. |

Idiotypic CEA |

Oncology |

Titan |

Dec, 2014 |

|

33. |

Insulin Glargin |

Diabetes |

Aventis |

April, 2014 |

|

34. |

Transtuzumab |

Biopharm |

Gentech |

Oct, 2014 |

|

35. |

Esomeprazole |

Gastro |

A.Z. |

May, 2014 |

|

36. |

Telmistran |

C.V. |

|

Jan, 2014 |

|

37. |

Omaptrilar |

C.V. |

B.M. |

June, 2015 |

|

38. |

Telethromycin |

Antibiotic |

Aventis |

April, 2015 |

|

39. |

Gemifloxacin |

Antibiotic |

GSK |

June, 2015 |

|

42. |

Omalizumb |

Respiratory |

Roche |

Feb, 2015 |

TABLE 1 List of the drugs going off patent in near future

3. Continue its expansion in the low-priced segment

Based on the present infrastructure of generic pharmaceutical firms, exports to unregulated markets can continue so that it can provide funds required for transition of some larger generic companies to research based companies.

4. Develop bio-generic drugs.

Indian bio-generics have to move beyond its domestic boundaries. The Indian government should lobby on the bilateral level to remove regulatory barriers in exporting the bio-generic products to regulated markets. A procedure for approval of drugs filed through Biologics Licensing Application needs to be established. And as soon as the FDA and the European Medicines Agency introduce an approval mechanism for bio-generics, India should move ahead in this field.

5 Comparative advantage in conducting clinical trials

The generic pharmaceutical companies can undertake clinical trials since India has a large population of treatment-naïve patients and plethora of diseases. But proper measures to control any abuse of recruitment of patients need to be taken care of.

(c)The third tier is for approaching new emerging markets.

(a) Generic generics

Currently, the market share of generic generics is very low. We see two main hurdles to pure genericisation of the Indian market:

1. Lack of generic generics regulations and guidelines for the establishment of bio-equivalence, for example the Abbreviated New Drug Application (ANDA) guidelines that exist in the U.S.

2. Doctor comfort derived from prescribing medications on the basis of brand name.

A good example of a generic generics programme in India is the government run ‘Jan Aushadi’. This programme provides no-name generic drugs at subsidized prices in 24-hour pharmacies that are located all over the country.

The free generics scheme, which mirrors policies in the states of Tamil Nadu and Rajasthan, is expected to be fully operational by the time voters go to the polls for the 2014 general election, when the populist Congress party will seek a third straight victory.Indian makers of generics such as Dr Reddy's and Cipla are best placed to benefit."The move will please the generics manufacturers who stand to gain substantially in competing for contracts,"

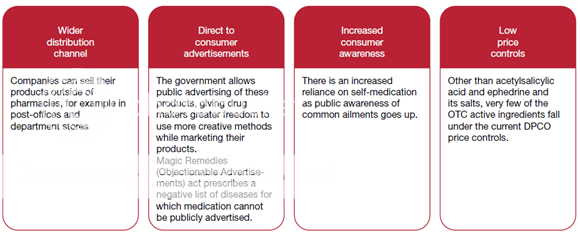

(b) Over-the-counter products

The OTC segment has been identified as one of the potential growth drivers for the Indian Pharma industry, as the sale of OTC drugs in India has been increasing over the years. The OTC market was worth about USD 1.8 billion in 2009 estimates that by 2020, it will grow to USD 11 billion. ‘OTC Drugs’ means drugs legally allowed to be sold ‘Over The Counter’ by pharmacists, without the prescription of a Registered Medical Practitioner. Although the phrase ‘OTC’ has no legal recognition in India, all the drugs not included in the list of ‘prescription-only drugs’ are considered to be non-prescription drugs (or OTC drugs).

Figure 8: Key driver growth behind the OTC segment

3. Retail vs. Institutional sales

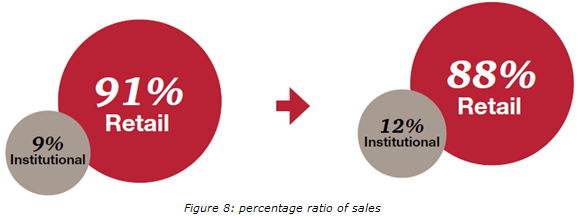

Currently, majority (91%) of drug sales is through the retail markets, while institutional sales are very low (9%). it believes that the increase in institutional sales will be marginal in the next 5 years, and will be significant impact between 2015 and 2020. Increased institutional sales will be driven by the increase in the penetration of insurance, and the growing number of government and private hospitals.

Figure 8: percentage ratio of sales

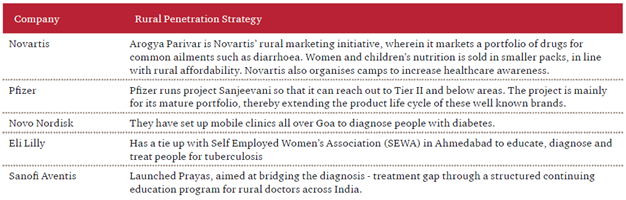

4. Rural Markets the next frontier

Majority of the Pharma market’s growth is driven by the urban markets. Accessibility ofmedication in rural areas is very poor,with less than 20% of the population having access.This gap represents a huge opportunity for pharmaceuticalcompanies to expand, and we believe that these markets will be the future volume drivers of the industry.

Figure 9: Multinational Pharmaceutical companies are looking to enter rural markets

5. Conclusion and remarks

The global pharmaceutical market is undergoing rapid transformation. As blockbuster drugs come off patent, there are fewer new products in the pipeline to replace them. Government must continue to invest in healthcare and medical infrastructure in rural markets, raise healthcare spending, encourage innovation, contain healthcare costs and work with private players to take the market to the next level. Amid slower growth in the generics space, large Indian players will look to enhance their focus in this area — it's never too early or too late to think about this critical challenge.Indian pharma companies can effectively leverage on the opportunities available and continue to be one of the leading pharma industries in the world.

6. References

1. Journal of Intellectual Property Rights Vol 17, July 2012, pp 273-283 Post-TRIPS Thrust Triggers for Indian Pharmaceuticals in the IP Context[Online] Accessed from: nopr.niscair.res.in/bitstream/.../JIPR%2013(4)%20273-238.pdf [Accessed on 24 Aug, 2012]

2. Journal of Intellectual Property Rights Vol 13, July 2008, pp 301-317 Battling with TRIPS: Emerging Firm Strategies of Indian Pharmaceutical Industry Post-TRIPS [Online] Accessed from: nopr.niscair.res.in/bitstream/.../JIPR%2013(4)%20301-317.pdf[Accessed on 28 Aug, 2012]

3. An unhealthy future for the Indian pharmaceutical industry? [Online] Accessed from: twnside.org.sg/title2/resurgence/2012/259/cover03.htm [Accessed on 28 july, 2012]

4. Pharma's Future Depends on These Three Trends by Sunil Gupta | April 26, 2010 ? [Online] Accessed from: lorandoslaw.com/Publications/Changes-in-Indias-Patent-Law.shtml [Accessed on 22 Aug, 2012]

5. finnegan.com/resources/articles/articlesdetail.aspx?news=24cedda7-28a3-4ac0-b100-ed9974123e67[Accessed on 24 Aug, 2012]

6. twnside.org.sg/title2/resurgence/2012/259/cover01.htm[Accessed on 10 july, 2012]

7. ispub.com/journal/the-internet-journal-of-third-world-medicine/volume-7-number-1/patents-regime-in-india-issues-challenges-and-opportunities-in-pharmaceutical-sector.html[Accessed on 6 July, 2012]

8. pharmainfo.net