About Author:

Mahendra N. Suthar

M.S.Pharm. Biotechnology,

National Institute of Pharmaceutical Education and Research,

Mohali, Punjab-160062.

mahendramevada8@gmail.com

Abstracts:

Biosimilars are protein product that are similar to branded biologics and approved by regulatory agencies. Biosimilars are cost effective and relatively cheaper than branded biologics. In pharmaceutical industry Biosimilars segments became one of the larger and lucrative one. The global Biosimilar segment has attended higher growth rate among them the USA and Europe are leading one. Further it very good opportunity for Pharmergings like India, China, Russia, Brazil etc. Specially India can replicate its well developed genetic segments and can attend higher growth in it. But, certain issues including immunogenicity, marketing competition and regulatory hurdles are needed to be addressed to propel further innovation in this segment. In present review various marketing opportunities, key issues and regulatory consideration for Biosimilars is described in detail.

REFERENCE ID: PHARMATUTOR-ART-1851

1. Introduction

Biosimilars are follow-on version of biologics; they are also known as biogenetics and launched after patent expiry of branded biologics1, 2, 3. After development of Omnitope (Human Growth hormone) by Sendoz in 2006 and get approved by European Medicines Agency (EMEA), saga of Biosimilars was started3, 4. Now a day Biosimilars segments became one of the larger and lucrative among the pharmaceutical industry of the globe. Biosimilars are seen cost effective alternative to high priced branded biologics2, 3. But still it faces many issues like, immunogenicity, efficacy, high development cost, regulatory hurdles and stiff marketing competition3,5. Various opportunities, issues and regulatory consideration of Biosimilars are discussed in coming section of this review.

2. Introduction of Biosimilars

Biosimilars are follow-on version of biologics; they are independently developed after when patent has expired of already existing biological medicine, 2, 3,. More precisely it is defined as,

“Biological medical products whichis similar in terms of quality, safety and efficacy to an already licensed reference biotherapeutic product and submitted to regulatory authorization by independent application after patent protection has expired for reference, 3, 6.”

They are also known as follow on protein products6(USA). Biosimilars are now firmly established by the European United (EU) as copy biologics with a clear and effective regulatory route for approval, which allows marketing of safe and efficacious biological products4. It is also known as similar biological products5. Some time inconsistency in nomenclature is used like follow-on biologic, subsequent entry biologic, similar biotherapeutic product, similar biological medicinal product, biogeneric, me-too biologic, non-innovator biologic, bio-betters etc2, 3. But now a day several countries have adopted an identical or similar regulatory approach to the EU for approval of Biosimilars and furthermore, World Health Organization (WHO) has also adopted this terminology in order to achieve harmony in regulations of Biosimilars3, 7. So, “Biosimilars (EU)” and “follow on protein products (USA)’’ are most accepted name by regulatory authorities4, 6, 7.

Omnitrope (Growth hormone, used in treatment of growth disturbance) is the first Biosimilar approved by European medicines agency (EMEA) in 20064. It is manufactured by the Swiss drug maker Novartis AG's generics unit Sandoz GmbH and it is independently developed from reference medicinal product Genotropin, which is manufactured by Pfizer3, 7. In 2011 FDA had approved M-Enoxaparin of Momenta Pharmaceuticals; Biosimilar version of sanofi-aventis’s blockbuster blood thinning drug, Lovenox (enoxaparin sodium)3, 5. Recently (Aprile-2013) Cipla has launched the first Biosimilar’ ‘’ETACEPT’’; from reference molecule Etarnercept in Indian market and it became a first Biosimilars for India8.

3. Biosimilars market at a glance

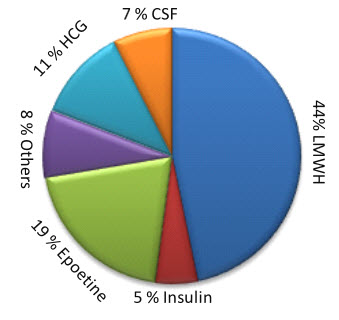

In 2011 global market of Biosimilars was around $2.5 billion and in 2012 it reached up to $3 billion9, 10. In present scenario it grows by about 20% compound annual growth rate (CAGR) at will reach around $7 billion in 201510, 11. In competitive front, Sandoz is leader in global market; Teva and Hospira are also major player in Biosimilars market9, 10. Low molecular weight heparin (LMWH), Growth hormones, Interleukines, Insulin etc. has high demand in pharmaceutical industry10.

Figure 1: Global Demands of various biologics

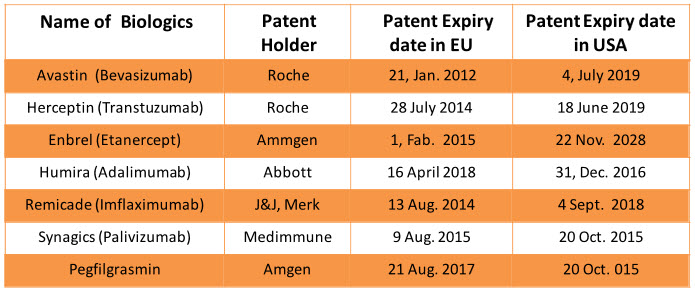

Before 2020 around $67 billion biological will go off-patented and they will come in segment of Biosimilars which will add bloom to business of Biosimilars12. Patent cliff of branded biologics is important factor for growth of Biosimilar segments1, 12. The patent protection of Epogen (Epoetin alfa) and Neulasta (Pegfilgrastrin) has already expired and following block blusters biologics will go off patented in the coming decade.

Table 1: Patent expiry date of branded biologics in EU and USA4, 6, 12, 13

India is one of the biggest sources of generic industry and is one of emerging market with high population14, 15. So, by replicating generics trends India becoming emerging and bigger hub for Biosimilars production and marketing14, 15. In India Dr. Reddy’s lab, Shantha Biotech, Intas, Cipla, Biocon, Reliance Life Science, Wockhardt etc. are major player of Biosimilars production14, 15. In 2008 around $200 million sales was recordedand in 2012 was reached around $580 million14, 15. It saw that Indian Biosimilars market grows by 30% CAGR. In coming time India will dominate in the globe like generic drug market14, 15.

4. Key issues with Biosimilars

1. Higher development cost but bridge to bloom

Development of Biosimilars is costlier compared to development of traditional generic drug. Development of Biosimilars requires higher R&D, manufacturing and approval cost, longer development time and further it has a sort half life16. Various industrial reports indicate that around 2 to 5 years and around $10 to $100 million investment required for development of Biosimilars16. Further it is no guaranty of success. But ones it get approval it gives higher rewards16.

Biosimilars are priced only 20% to 30% lesser price to reference branded drugs16and further Biosimilars are seen cost effective alternative to high priced branded biologics, offering cost advantages to both player and patients17, 18. Due to complex structure it is not easy to copy it. Some of branded biologics company file application for their off patented drugs and enjoy further monopoly in the market17.

2. Safely and efficiency issue

Due to larger biological structure and heterogeneity immunogenicity and patient safety is a prime concern for Biosimilars, further it is difficult to predict and can be medical emergency18, 19. For example in EU-licensed version of erythropoietin caused severe immunogenicity reactions while no USA cases were observed20. The recent EMEA guidelines on comparability of Biosimilars state that preclinical data may be insufficient to demonstrate immunologic safety of some Biosimilars4, 19.In these cases, the immunological safety can only be demonstrated in cohorts of patients enrolled in clinical trials and post marketing surveillance19.The radio immune precipitation assay and double antigen bridging ELISA assay are also sensitive assays for detecting high affinity antibodies. However, there is a need to validate and standardize these assays19.

In vitro bioavailability saw significant difference; some time it saws 20% to 120% variation. Thus, it is not easy to determine bioavailability of Biosimilars by in vitro bioequivalence study21. Only clinical data obtained from cohort of patients is suitable to compare it with reference biologic. Some time it saw significant difference in patient to patient, so more research is required to establish suitable bioequivalence models21.

NOW YOU CAN ALSO PUBLISH YOUR ARTICLE ONLINE.

SUBMIT YOUR ARTICLE/PROJECT AT articles@pharmatutor.org

Subscribe to Pharmatutor Alerts by Email

FIND OUT MORE ARTICLES AT OUR DATABASE

3. Interchangeability and nomenclature

Interchangeability are nomenclatures are areas which yet to be fully addressed by regulatory authorities19. Interchangeable biological product is one that may be substituted by reference product without intervention of health care providers who prescribed the reference products19. FDA does not accept Biological license application (BLA) during 12 years of data exclusive periods of branded biologics6, 19.After this period first BLA applicant get 12 months (sometimes 42 month) of market exclusivity if pass special conditions. Marketing exclusive rights is only for interchangeable biologics, not for Biosimilars6.

Nomenclature of Biosimilars continues to thorny issues for regulatory agencies. Under the WHO’s current international nonproprietary name (INN) policy, non-glycosylated Biosimilars receive the same INN, but glycosylated Biosimilars are difference, they should have different name22. WHO sees two problems in nomenclature; the first, regulators are likely to run out of Greek letters for glycosylated Biosimilars22. And second, the use of identical INNs for other Biosimilars could lead to inadvertent switching at the pharmacy. So this solution of this dispute in nomenclature is highly awaited.

4. Marketing challenges

Biosimilars are expensive to develop and priced more than generic drugs. Biosimilars are priced only 20% to 30% lower than branded reference biologics16. Further penetration law immediately after launch and grow relatively slow. Sales force is necessary to detail to specialist, high marketing cost, ongoing clinical trials are necessary to support the sales23. The issue of brand in the mind of physicians and patients is also prevalent. Further Biosimilars faces stiff marketing competition like generic drug. So to tackle all this problems effective marketing strategies and high marketing budget is necessary23.

5. Regulatory consideration of Biosimilars

The EMA has taken the lead in the regulatory approval framework for Biosimilar products4, and WHO has published guidelines on the evaluation of Biosimilars in order to facilitate the global harmonization23. Based on EMA and WHO guidelines, many other countries such as USA, Canada, Japan and India have also issued their own guidance for evaluating follow-on biologics24.

1. US regulatory framework

In USA before March 2009 some of Biologics and Biosimilars were approved by section 505 (b) (2) Of Hatch-Waxman acts9. But after tragedy of Omnitrope, USA has enacted Biologics Price competition and innovation act in 2009 (BPCI act) as a part of patient protection and affordable act on March 201024, 25. Section 351 (k) of Public Healthcare Service act (PHS) added by BPCI act. Under provision of this act biologics product is granted as Biologics License Application (BLA) and gives 12 year data exclusivity for newly approved biologics6, 25. Further after patent expiry of branded biologics, Biosimilars are approved as abbreviated BLA (aBLA) like Abbreviated New Drug Application (ANDA) of generic drug approval6, 25.

In February 2012, US FDA issued three draft guidance documents as recent on Biosimilar product development to assist industry in developing such products in the US6. These draft guidance covers scientific and quality considerations in demonstrating biosimilarity to reference product6. These provide an overview of analytical factors to consider when assessing biosimilarity for the purpose of submitting a 351(k) application6, 25. This includes the importance of extensive analytical, physico-chemical and biological characterization in demonstrating that the proposed Biosimilar product is highly similar to the reference product25.

2. European regulatory framework

In EU, European Medicines Agency (EMA) is responsible for regulation of Biosimilars and it is the first regulatory agency of the globe to establish Biosimilars regulation framework4, 24, 26. Omnitrope (somatropin) was the first product approved in the EU as a Biosimilar, in 20064, 24. The Committee for Medicinal Products for Human Use (CHMP) issues specific guidelines concerning the scientific data to be provided to substantiate the claim of similarity. In EU Biosimilars are approved by European Commission (EC) through centralized process (CP)4, 26. The CP consists of one submission, one assessment by CHMP, one decision by EC and one authorization valid for all the countries of EU, Norway, Iceland and Liechtenstein. EMA believes that Biosimilars are similar to generics and like generics they are also part of EU legislation but they have some peculiarities that some clinical studies are needed so Biosimilars are approved by Marketing Authorization Application (MAA)4, 26. In addition CHPM also developed additional guidance documents addressing both the quality, non-clinical and clinical aspects for the development of similar biological medicinal products4, 26.

3. Indian regulatory Scenario

Indian regulatory authority is not fully framed like FDA and EMA. In India, apart from Central Drugs Standard control Organization (CDSCO), Drug Controller General of India (DGCI), some other competent authorities are involved especially in regulation of Biosimilars4, 27, 28. CDSCO gives manufacturing permission, analyze and examine the sample27. DGCI gives the marketing permission of indigenously manufactured as well as imported Biosimilars28, 28. Institutional Biosafety committee (IBSC) looks after R&D activity of Biologics and Biosimilars developments28, 29. Review Committee of Genetic Manipulation (RCGM) regulates import-export, Caring out research and preclinical research28, 29. Genetic Engineering Appraisal Committee (GEAC) regulates activities involving use of large Living Modified Organism (LMO) in production of Biologics28, 29. Further in March, 2011, New Drug Advisory Committee (NDAC) came in to existence with regulates any new substance of chemical or biological introduced in first time in India27, 28. It is also applied to generic drugs and Biosimilars because both involve change in dose or combination.

To over comes this multiple regulation and also to strengthen regulation of biological in India Department of Biotechnology (DBT) has proposed National Biotechnology Regulation Acts (NBR act) in May, 2008. In this act provision of establishment of Biotechnology Regulatory Authority of India (BRAI) for regulation of Biotechnological products was proposed. BRAI act bill was proposed many times in parliament with new amendments, but still it is not enacted. BRAI act is highly awaited by Biotechnology sectors of India.

6. Conclusion

Biosimilars segment is one of the fastest growing and lucrative sectors of pharmaceutical industry of the globe. From last decade very high growth rate was recorded in it. Biosimilars are cheaper than branded biologics and beneficial for patient and physician both. USA and EU are big player in this section and pharmerging like India, China and Brazil are also emerging country. Specially India can replicate its well developed generic model and can become leading country in this segment. Various regulatory agencies are establishing framework for regulation of Biosimilars, but it is still fully not established, so new reforms and strategies are highly awaited to address certain regulatory hurdles. Certain issues like immunogenicity, efficacy, high R&D cost, high marketing budget etc. are needed to address to boost business of Biosimilars.

Acknowledgements:

This article is dedicated to my beloved family and beauty of the life. I want to acknowledge my institute NIPER, Mohali for providing me platform for my academic success by delivering quality of education and providing me very good resources. I acknowledge my friends Divyesh, Avadhesh, Maulik, Tejas and to all NIPERITES for supporting and appreciating me for this work. Last but not the least I thank Almighty, for all his blessings he bestowed upon me.

References:

1.Ian Evans. Follow-on Biologics: a new play for big Pharma. Yale journal of biology and medicine, 83 (1), 2010.

2.Huub Schellekens. Biosimilar therapeutics—what do we need to consider? NDT Plus, 2 (1) 2009.

3.Monika Misra. Biosimilars: Current perspectives and future implications. Indian J Pharmacology, 44(1) 2012.

4.European medicines agency. ema.europa.eu. March-2013.

5.Dr Ranjani Nellore. Regulatory Considerations for Biosimilars. Perspective Clinical Research, 1(1) 2011.

6.Food and drug administration. fda.gov. March -2013.

7.Sandoze. sandoze.com. March-2013.

8.Cipla. www.cipla.com March-2013.

9. Biosimilar accessible market: Size and biosimilar penetration. imshealth.com. March-2012.

10.Global Biosimilars Market Report: 2012 Edition -Market Research Report. prlog.com. March-2013.

11.Global Biosimilars Market Forecast to 2015. PRNewswire, March-2012.

12.Generic and Biosimilars initiative. gabionline.net, March-2013.

13.Fiercepharma. fiercepharma.com, March-2013.

14.Jay P. Desai. Bridge to bloom: future of Indian Biosimilars. Universal consultancy, September 2009.

15.Indian Biosimilars market. biosimilrsnews.com, March-2013.

16. Andrew W. Wilson1 and Peter J. Neumann. The cost-effectiveness of biopharmaceuticals. mAbs, 4(2) 2012.

17.Shaping the Biosimilars opportunity: A global perspective on the evolving biosimilars landscape December. imshealth.com. March 2011.

18.Oseph Miletich, Geoffrey Eich and Gustavo Grampp. Biosimilars 2.0: Guiding principles for a global “patients first” standard. mAbs 3 (3) 2011.

19.Hans C Ebbers, Stacy A Crow. Interchangeability, immunogenicity and Biosimilars Nature Biotechnology, 2012.

20.Schellekens H. Recombinant human erythropoietin, Biosimilars and immunogenicity. Journal of Nephrology, 21(4) 2008.

21.Yellela Sri Rama Krishnaiah, Bioequivalence of Follow-on Biologics or Biosimilars. Journal of Bioequivalence & Bioavailability, 1(2) 2009.

22.World health organization. www.who.int. March-2013.

23. Lisa S. Rotenstein, and Joseph P. Opportunities and Challenges for Biosimilars: What’s on the Horizon in the Global Insulin Market? Clinical Diabetes, 30 (4), 2012.

24.Jun Wang, and Shein-Chung Chow. On the Regulatory Approval Pathway of Biosimilar Products. Pharmaceuticals, 5, 2012.

25.Jonathan Kay. Biosimilars: a regulatory perspective from America Kay Arthritis Research & Therapy 112 (13) 2011.

26.Minghetti P, Rocco P and Cilurzo F. The regulatory framework of Biosimilars in the European Union. Drug Discovery Today, 17(1) 2012.

27.Central drug standard control organization. cdsco.nic.in, March-2013

28.Dr. Bobby George Current regulations governing Biosimilars. Pharma Times, 44 (5) 2012.

29.Institute of Biosafety committee. dbtbiosaftety.nic.in. March-2013.

30.Department of Biotechnology. dbtindia.nic.in. March-2013.

NOW YOU CAN ALSO PUBLISH YOUR ARTICLE ONLINE.

SUBMIT YOUR ARTICLE/PROJECT AT articles@pharmatutor.org

Subscribe to Pharmatutor Alerts by Email

FIND OUT MORE ARTICLES AT OUR DATABASE