The US Federal Drug Administration is aiming to cut the time-to-market and the development costs for new drugs. This will help drive growth in the market for biologics, where over 1000 drugs are currently under development, to 9.6% year on year from its recent rate of 5.4%. Unlike small-molecule drugs that are manufactured through organic or inorganic chemical synthesis, biologics are manufactured by living cells. Biologics are more complex, fragile and difficult to manufacture than small molecules. They cost more to bring to market than the $2 billion average to develop a new drug, despite a trend to outsource development to contract research organizations.

[adsense:336x280:8701650588]

The changes being implemented or considered by the FDA include allowing organ-on-chip trials to be substituted for animal trials in the early stages of the process, allowing the inclusion of non-trial data from patients, and changing the end-point benchmark from proving that the drug extends overall survival to showing that it prolongs the time a patient lives without the disease getting worse. Other changes include allowing biologics license applicants to obtain standard preparations for biologics (standard solutions containing a precisely known concentration of an element) from sources other than the FDA’s Center for Biologics Evaluation and Research, or to develop them internally. The FDA has also removed a rule (Section 610.21 of the FDA code) which specifies minimal potency limits to be met for certain antibodies and antigens. These changes will increase the rate of approvals in the world's largest biologics market, the USA, from its 2017 level of 12 new biolics. Furthermore, where the FDA leads, other regulators often follow.

Biologics are very large complex molecules manufactured in living systems such as microorganisms, animal cells or plant cells. They are produced using recombinant DNA technology and are composed of sugars, proteins, nucleic acids or a combination of these substances.

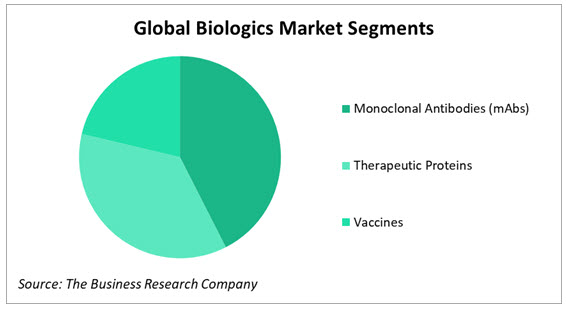

Monoclonal antibodies (mAbs) are the largest segment of the biologics market, followed by therapeutic proteins and vaccines. All three segments are growing at over 9% year on year. mAbs recognize and bind to a specific antigen that causes a chronic health conditions such as arthritis, cancer or multiple sclerosis. mAbs can be further segmented by source into murine mAbs, chimeric mAbs, human and humanized mAbs; humanized source mAbs are currently the largest segment. Therapeutic proteins are engineered in the laboratory and work by targeting the therapeutic process which compensates for the deficiency of an essential protein. Therapeutic proteins include cytokines, peptide hormones and enzymes. Vaccines are biological preparations that stimulate the immune system and prepare it to fight future infections caused by pathogens. Biologic vaccines hold out hope for better treatment of viral infections and replacement of antibiotics. The therapeutic areas where the largest number of biologics are being developed are cancer, rare diseases, neurological disorders, autoimmune disorders, heart disease and stroke, diabetes, mental health disorders and Alzheimer's, in that order.

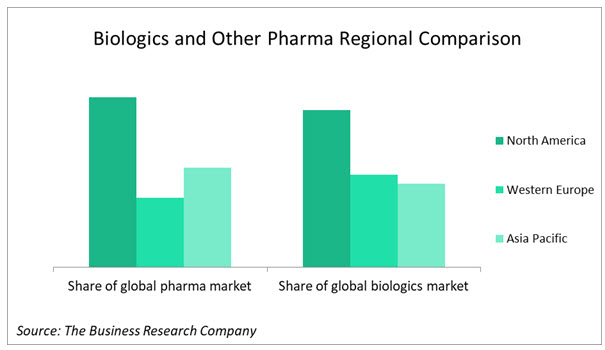

North America is the leading region for both biologic and other pharma sales but the story is different in second and third place. Asia Pacific has overtaken Western Europe in small-molecule drug sales but in biologics, Western Europe is still ahead of Asia Pacific. The high cost of biologics, making them more affordable in affluent Western Europe, the greater prevalence there of the age-related diseases that many current biologics are designed to treat, and the more rapid growth of the biosimilars market in Asia Pacific account for this difference.

The USA's biologics market is by far the world's largest, worth seven times that of the second largest, Japan. Growth, however is widespread, with the BRICs (Brazil, Russia, India and China) in the lead. For instance, growth in India's tiny market has surged recently, from the 12.4% CAGR it was achieving up to 2017, to 21%. Growth has also accelerated in the European markets - the UK, France, Spain, German and Italy are all now seeing double-digit growth. as is the otherwise often somnolent market of Japan. Growth in the US market, though a little slower in percentages, is of course worth most in dollars.

The global biologics market is fairly concentrated, with ten companies accounting for over 80% of sales. The US's Johnson & Johnson is in the lead, closely followed by Swiss company Hoffman-La Raoche. Bristol-Myers Squibb, Glaxo Smith-Kline and AbbVie Inc are other key players.

Consolidation, rationalisation and development-driven M&A are taking place, particularly in the vaccine segment. For example, GlaxoSmithKline acquired Swiss company Okairos AG for 250 million euros ($325 million), to enable GSK to develop vaccines in-house; CSL acquired the influenza vaccine business of Novartis, a much bigger company; and in November 2016, Eagle Pharmaceuticals acquired Arsia Therapeutics, another relatively small pharma business, for $30 million.